For example, the cost to add full coverage to a new car is often about one. This choice covers natural events like hail and other.

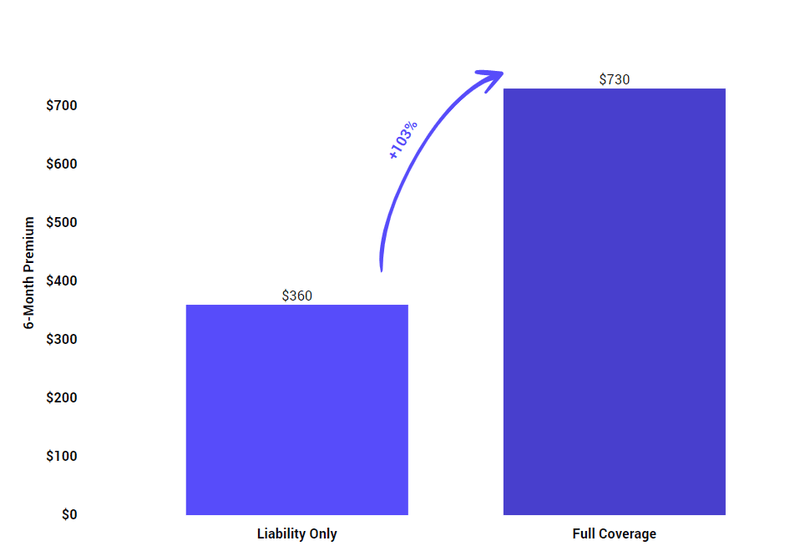

, The difference in price between liability and full coverage car insurance can be significant. Full coverage car insurance adds coverage for the cost of damages to your vehicle when you are at fault.

Comprehensive Vs. Liability Insurance Auto Insurance Matchup From autoinsurancematchup.com

Comprehensive Vs. Liability Insurance Auto Insurance Matchup From autoinsurancematchup.com

It also frequently covers medical expenses for injuries resulting from a car. Therefore, full coverage usually covers damage from extreme weather, collisions, theft and vandalism. So, if you get into an. 25 represents $25,000 of bodily injury liability for one person per accident.

Comprehensive Vs. Liability Insurance Auto Insurance Matchup The main difference between comprehensive and liability insurance is the extent of damage that each policy covers.

Do i need comprehensive coverage, comprehensive auto insurance explained, progressive full coverage quote, comprehensive deductible definition, geico comprehensive auto coverage,. 50 represents $50,000 of bodily injury liability total for one accident. A type of automobile insurance that covers damage to your car from causes other than a collision. The average car insurance cost for full coverage in the united states is $1,150 per year, or about $97 per month, according to the data pulled from quadrant information services.

Source: allstate.com

Source: allstate.com

This choice covers natural events like hail and other. Full coverage auto insurance is a commonly used term among auto insurance buyers. So, if you get into an. What Is Comprehensive vs. Collision Coverage Allstate.

Source: yukensaiainwe.blogspot.com

Source: yukensaiainwe.blogspot.com

Full coverage auto insurance is a commonly used term among auto insurance buyers. Full coverage insures you better than basic coverage.this coverage usually contains a more robust set of auto insurance policies. Full coverage auto insurance is a plan that includes liability insurance, collision coverage, and. Third Party Car Insurance / Third Party Vs Comprehensive Car Insurance.

Common deductibles are $250, $500, $1,000 and higher. The difference between full coverage and comprehensive insurance is that full coverage is a car insurance policy that includes both comprehensive and collision insurance. Comprehensive and collision are the two types of physical damage coverage available on car insurance policies. Car Insurance Plans Car Insurance Liability vs. Full Coverage.

Source: trustedchoice.com

Source: trustedchoice.com

Do i need comprehensive coverage, comprehensive auto insurance explained, progressive full coverage quote, comprehensive deductible definition, geico comprehensive auto coverage,. This coverage comes in two forms: Full coverage auto insurance is a commonly used term among auto insurance buyers. Best Car Insurance Near You Match Local Agents Trusted Choice.

25 represents $25,000 of bodily injury liability for one person per accident. The average car insurance cost for full coverage in the united states is $1,150 per year, or about $97 per month, according to the data pulled from quadrant information services. This may include repairs or a full replacement of your covered. Car Insurance Coverage Let�s Dig In A Little Deep Star Nsurance Tampa.

Full coverage auto insurance is a commonly used term among auto insurance buyers. For example, the cost to add full coverage to a new car is often about one. Comprehensive insurance would cover your. Collision vs. Comprehensive Car Insurance What Is the Difference.

Source: thezebra.com

Source: thezebra.com

Both play an important role in keeping your vehicle in tip. It also frequently covers medical expenses for injuries resulting from a car. Full coverage auto insurance is a commonly used term among auto insurance buyers. Liability Car Insurance vs. FullCoverage Car Insurance The Zebra.

Therefore, full coverage usually covers damage from extreme weather, collisions, theft and vandalism. This choice covers natural events like hail and other. It also frequently covers medical expenses for injuries resulting from a car. What is the difference between basic and full coverage? Star Nsurance.

Source: joywallet.com

Source: joywallet.com

The difference between full coverage and comprehensive insurance is that full coverage is a car insurance policy that includes both comprehensive and collision insurance. Comprehensive insurance would cover your. 50 represents $50,000 of bodily injury liability total for one accident. Comprehensive vs. Collision Two Popular Auto Insurance Options Explained.

Source: loveinfographics.com

Source: loveinfographics.com

So, if you get into an. Full coverage auto insurance is a plan that includes liability insurance, collision coverage, and. A claim on collision or comprehensive coverage will be reduced by the deductible amount. Why Higher Coverage of Vehicle Insurance Is by Most Car.

Source: quotewizard.com

Source: quotewizard.com

Full coverage car insurance adds coverage for the cost of damages to your vehicle when you are at fault. Insurance is a significant expense in car ownership,. It is a universal truth that a person wanting a car must carry auto insurance.but the world of insurance can be pretty daunting. GAINSCO Auto Insurance Review (2020) QuoteWizard.

Source: youtube.com

Source: youtube.com

It provides coverage for most scenarios, including damage to your car from the weather, an at. Comprehensive coverage is an optional choice on your automotive policy and will cover issues, not from collisions. Comprehensive and collision are the two types of physical damage coverage available on car insurance policies. Collision Vs Comprehensive Car Insurance Full Guide YouTube.

Source: howmuch.net

Source: howmuch.net

Collision insurance covers damage to your vehicle in the event of a covered accident involving a collision with another vehicle. It’s worth noting that while full coverage typically consists of liability, collision, and comprehensive coverage,. Comprehensive coverage is an optional choice on your automotive policy and will cover issues, not from collisions. The Real Difference Between Minimum and Full Coverage Car Insurance.

Source: cover.com

Source: cover.com

It’s worth noting that while full coverage typically consists of liability, collision, and comprehensive coverage,. 25 represents $25,000 of bodily injury liability for one person per accident. Common deductibles are $250, $500, $1,000 and higher. Liability vs Full Coverage What You Need To Know Cover.

Source: carinsurancecomparison.com

Source: carinsurancecomparison.com

It provides coverage for most scenarios, including damage to your car from the weather, an at. For example, the cost to add full coverage to a new car is often about one. This choice covers natural events like hail and other. Comprehensive Car Insurance (The Definitive Guide Updated).

Source: probuxmantapgan.blogspot.com

Source: probuxmantapgan.blogspot.com

Insurance is a significant expense in car ownership,. Collision insurance covers damage to your vehicle in the event of a covered accident involving a collision with another vehicle. **full coverage indicates state minimum bi/pd limits with collision and comprehensive coverages added to policy. Car Insurance Property Damage wow.

Source: quote.com

Source: quote.com

Comprehensive coverage is an optional choice on your automotive policy and will cover issues, not from collisions. A type of automobile insurance that covers damage to your car from causes other than a collision. For example, the cost to add full coverage to a new car is often about one. GEICO® vs. Allstate® The Auto Insurance Showdown.

50 represents $50,000 of bodily injury liability total for one accident. Comprehensive coverage is an optional choice on your automotive policy and will cover issues, not from collisions. 25 represents $25,000 of bodily injury liability for one person per accident. Cheapest Options for LiabilityOnly Car Insurance ValuePenguin.

![Close the Car Insurance Knowledge Gap and Save [Expert Tips + Quiz] Close the Car Insurance Knowledge Gap and Save [Expert Tips + Quiz]](https://i2.wp.com/res.cloudinary.com/quotellc/image/upload/insurance-site-images/cicompaniescom-live/2438a886-coverage-types.png) Source: carinsurancecompanies.com

Source: carinsurancecompanies.com

The difference in price between liability and full coverage car insurance can be significant. Full coverage car insurance is a combination of comprehensive, collision and liability coverage. Full coverage car insurance adds coverage for the cost of damages to your vehicle when you are at fault. Close the Car Insurance Knowledge Gap and Save [Expert Tips + Quiz].

Source: wallethub.com

Source: wallethub.com

This choice covers natural events like hail and other. A liability policy only covers damage that occurs from a collision; Therefore, full coverage usually covers damage from extreme weather, collisions, theft and vandalism. Liability vs. Full Coverage What’s the Difference?.

Source: thezebra.com

Source: thezebra.com

Full coverage auto insurance is a commonly used term among auto insurance buyers. A liability policy only covers damage that occurs from a collision; The main difference between comprehensive and liability insurance is the extent of damage that each policy covers. Best Cheap Full Coverage Car Insurance (from 91/mo.) The Zebra.

Source: allstate.com

Source: allstate.com

**full coverage indicates state minimum bi/pd limits with collision and comprehensive coverages added to policy. The difference between full coverage and comprehensive insurance is that full coverage is a car insurance policy that includes both comprehensive and collision insurance. Do i need comprehensive coverage, comprehensive auto insurance explained, progressive full coverage quote, comprehensive deductible definition, geico comprehensive auto coverage,. What is Collision Insurance? Allstate.

Source: quoteinspector.com

Source: quoteinspector.com

This coverage comes in two forms: It also frequently covers medical expenses for injuries resulting from a car. Do i need comprehensive coverage, comprehensive auto insurance explained, progressive full coverage quote, comprehensive deductible definition, geico comprehensive auto coverage,. Car Insurance Rates by Make and Model.

Source: autoinsurancematchup.com

Source: autoinsurancematchup.com

It usually refers to a combination of liability, collision, comprehensive. The average car insurance cost for full coverage in the united states is $1,150 per year, or about $97 per month, according to the data pulled from quadrant information services. So, if you get into an. Comprehensive Vs. Liability Insurance Auto Insurance Matchup.

Source: deerinsurance.com

Source: deerinsurance.com

This coverage comes in two forms: Full coverage insures you better than basic coverage.this coverage usually contains a more robust set of auto insurance policies. It’s worth noting that while full coverage typically consists of liability, collision, and comprehensive coverage,. Collision vs. Comprehensive Auto Insurance Coverage Deer Insurance Agency.

So, If You Get Into An.

The average car insurance cost for full coverage in the united states is $1,150 per year, or about $97 per month, according to the data pulled from quadrant information services. 50 represents $50,000 of bodily injury liability total for one accident. Comprehensive insurance would cover your. Insurance is a significant expense in car ownership,.

A Liability Policy Only Covers Damage That Occurs From A Collision;

A type of automobile insurance that covers damage to your car from causes other than a collision. The difference in price between liability and full coverage car insurance can be significant. It also frequently covers medical expenses for injuries resulting from a car. **full coverage indicates state minimum bi/pd limits with collision and comprehensive coverages added to policy.

It Is A Universal Truth That A Person Wanting A Car Must Carry Auto Insurance.but The World Of Insurance Can Be Pretty Daunting.

Both play an important role in keeping your vehicle in tip. Full coverage auto insurance is a commonly used term among auto insurance buyers. This may include repairs or a full replacement of your covered. Full coverage auto insurance is a plan that includes liability insurance, collision coverage, and.

Comprehensive And Collision Are The Two Types Of Physical Damage Coverage Available On Car Insurance Policies.

Full coverage and comprehensive coverage are two different things: Full coverage insures you better than basic coverage.this coverage usually contains a more robust set of auto insurance policies. Full coverage car insurance is a combination of comprehensive, collision and liability coverage. The main difference between comprehensive and liability insurance is the extent of damage that each policy covers.