Thus, a mortgage lender will charge a person with poor or bad credit a higher interest rate to refinance because the lender is taking more of a risk by lending that person money. Check your credit report and.

, Auto credit express is not. Doing so can be a good idea, especially if you can get a cosigner whose credit is in good.

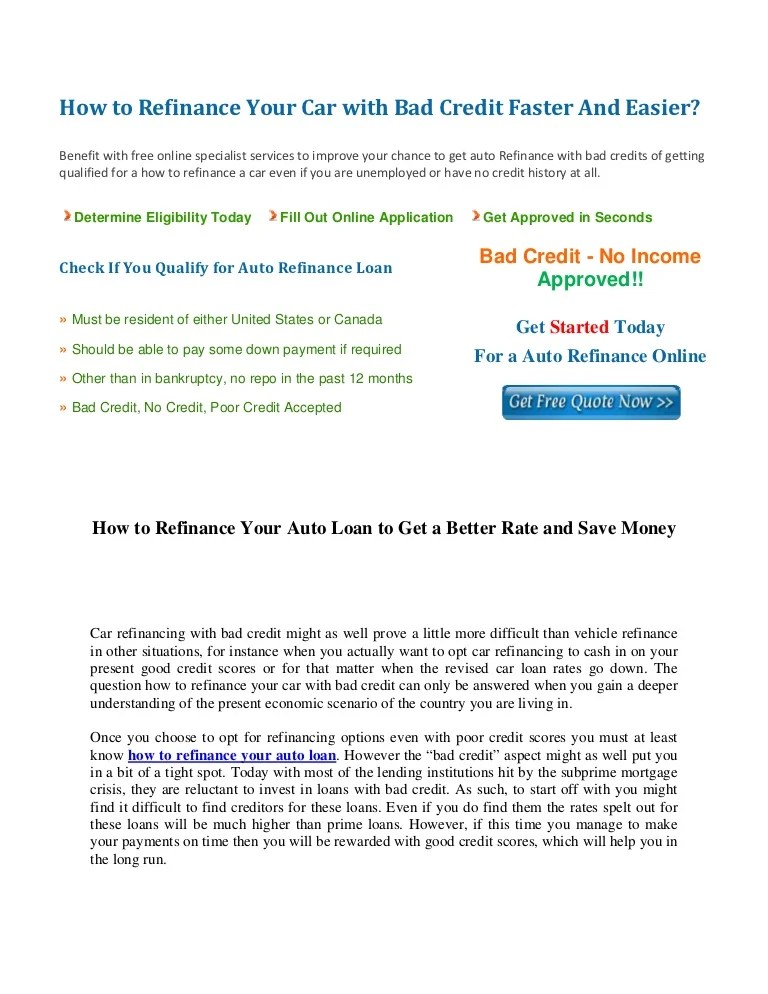

How To Refinance A Car With Bad Credit From slideshare.net

How To Refinance A Car With Bad Credit From slideshare.net

For many people, it is the only way to get financing for a large purchase like a car when most. In general, you also dont want to refinance your car loan if youll end up extending the loans term. An example is easiest here: Even though you are taking out a new loan, you will only have one auto loan.

How To Refinance A Car With Bad Credit If you have a higher credit score than it was at the time of the original loan.

If you want to save on your loan and get to refinancing faster, round up your auto. First, you could take the opportunity to secure lower interest rates. Thus, a mortgage lender will charge a person with poor or bad credit a higher interest rate to refinance because the lender is taking more of a risk by lending that person money. Credit history length and new credit.

Source: slideshare.net

Source: slideshare.net

Even though you are taking out a new loan, you will only have one auto loan. Thus, a mortgage lender will charge a person with poor or bad credit a higher interest rate to refinance because the lender is taking more of a risk by lending that person money. But if you’ve already applied and end up being denied for refinancing, the steps to take are the same. How Can I Refinance My Car with Bad Credit.

Source: slideshare.net

Source: slideshare.net

If you badly need to refinance your car no matter what, try to follow these steps: Refinancing a vehicle with negative equity auto credit express. Using auto credit express to shop for refinancing options can help make your job a lot easier—if you meet the qualifications. How Can I Refinance My Car with Bad Credit.

Source: slideshare.net

Source: slideshare.net

For many people, it is the only way to get financing for a large purchase like a car when most. Refinancing a car with bad credit isn’t impossible, but it can pose a challenge for borrowers with lower credit scores. Check your credit report and. Where Can I Refinance My Car With Bad Credit.

Source: slideshare.net

Source: slideshare.net

If you’re trying to decide if you can refinance a car loan with bad credit, you should have a general idea of where your credit score falls. But if you’ve already applied and end up being denied for refinancing, the steps to take are the same. Take a look at your current auto loan and see if there’s any prepayment penalty. How To Refinance A Car With Bad Credit.

Source: pinterest.de

Source: pinterest.de

Refinancing is the process of taking out a new auto loan to pay off the remaining balance on your existing auto loan. When you refinance your car, it will affect two of your credit categories: Getting a car loan with bad credit will slim down your list of potential lenders to shop. Refinance Car Loans for Bad Credit and Save Money on Your Monthly.

Source: carretro.blogspot.com

Source: carretro.blogspot.com

But if you’ve already applied and end up being denied for refinancing, the steps to take are the same. If you badly need to refinance your car no matter what, try to follow these steps: If you want to save on your loan and get to refinancing faster, round up your auto. Need To Refinance My Car Loan With Bad Credit Car Retro.

Source: pinterest.com

Source: pinterest.com

You refinance that loan after two years at 12% for the remaining amount of $14,257.98. The credit requirements will vary by lender. Pros and cons of refinancing a car: Getting car loan refinance with bad credit is now easy to apply online.

Source: slideshare.net

Source: slideshare.net

If you want to save on your loan and get to refinancing faster, round up your auto. Refinancing a car with bad credit isn’t impossible, but it can pose a challenge for borrowers with lower credit scores. Auto credit express has long been one of our favorite auto lending networks for bad credit because it partners with a massive group of lenders who each have flexible credit. Refinancing Car Loan With Bad Credit Instant Approval.

Source: refinancecarloanbadcredit.wordpress.com

Source: refinancecarloanbadcredit.wordpress.com

In case there is, pay it off to finalize. Gettys on jan 11, 2022. Getting a car loan with bad credit will slim down your list of potential lenders to shop. Refinance Car Loans for Bad Credit and Save Money on Your Monthly.

Source: carretro.blogspot.com

Source: carretro.blogspot.com

Refinance car loans with bad credit online. Thus, a mortgage lender will charge a person with poor or bad credit a higher interest rate to refinance because the lender is taking more of a risk by lending that person money. The process to refinance a car with bad credit score. Is Refinancing A Car Loan Bad For Your Credit Car Retro.

Source: slideshare.net

Source: slideshare.net

Auto credit express has long been one of our favorite auto lending networks for bad credit because it partners with a massive group of lenders who each have flexible credit. Take a look at your current auto loan and see if there’s any prepayment penalty. Refinance car loans with bad credit online. Where Can I Refinance My Car With Bad Credit.

Source: slideshare.net

Source: slideshare.net

Getting a car loan with bad credit will slim down your list of potential lenders to shop. Doing so can be a good idea, especially if you can get a cosigner whose credit is in good. First, you could take the opportunity to secure lower interest rates. How Can I Refinance My Car with Bad Credit.

Source: slideshare.net

Source: slideshare.net

Can i refinance a car loan with bad. How refinancing can affect your credit score. You refinance that loan after two years at 12% for the remaining amount of $14,257.98. How To Refinance A Car With Bad Credit.

Source: slideshare.net

Source: slideshare.net

The process to refinance a car with bad credit score. Doing so can be a good idea, especially if you can get a cosigner whose credit is in good. Credit history length and new credit. How to Refinance Your Car with Bad Credit.

Source: slideshare.net

Source: slideshare.net

For many people, it is the only way to get financing for a large purchase like a car when most. This may have mauled your credit score badly, leaving you down in the dumps. In fact, you should expect to receive loan offers with less favorable loan terms if you have a bad credit score. Refinancing Car Loan With Bad Credit Instant Approval.

Source: slideshare.net

Source: slideshare.net

You took out a car loan of $10,000 with an interest rate of 11%. Getting a car loan with bad credit will slim down your list of potential lenders to shop. There are certain lenders that specifically work with. Refinancing Car Loan With Bad Credit Instant Approval.

Source: slideshare.net

Source: slideshare.net

Thus, a mortgage lender will charge a person with poor or bad credit a higher interest rate to refinance because the lender is taking more of a risk by lending that person money. 4 hours ago round up your payment. Using auto credit express to shop for refinancing options can help make your job a lot easier—if you meet the qualifications. Refinancing Car Loan With Bad Credit Instant Approval.

Source: loanwalls.blogspot.com

Source: loanwalls.blogspot.com

For many people, it is the only way to get financing for a large purchase like a car when most. When you refinance your car, it will affect two of your credit categories: Refinancing could even further dip your credit (temporarily). Bad Credit Need To Refinance Auto Loan Loan Walls.

Source: slideshare.net

Source: slideshare.net

- improve your credit rating. In case there is, pay it off to finalize. The good news is that yes, you can often refinance your car, even with bad credit. How To Refinance A Car With Bad Credit.

Source: slideshare.net

Source: slideshare.net

Auto credit express is not. Refinancing a vehicle with negative equity auto credit express. Refinancing an auto loan with bad credit. How To Refinance A Car With Bad Credit.

Source: slideshare.net

Source: slideshare.net

This is usually done because the new loan has better terms than your existing loan. Do not immediately try to get another loan through a different lender. Pros and cons of refinancing a car: How To Refinance A Car With Bad Credit.

Source: carretro.blogspot.com

Source: carretro.blogspot.com

Is it right for you? Thus, a mortgage lender will charge a person with poor or bad credit a higher interest rate to refinance because the lender is taking more of a risk by lending that person money. Pros and cons of refinancing a car: How Much Would My Car Payment Be If I Refinanced Car Retro.

Source: slideshare.net

Source: slideshare.net

A subprime loan is for people with bad credit and low fico scores. In fact, you should expect to receive loan offers with less favorable loan terms if you have a bad credit score. Auto credit express is not. Auto Refinance Loans for People With Bad Credit.

Source: monstertroubleshooter.blogspot.com

Source: monstertroubleshooter.blogspot.com

When you refinance your car, it will affect two of your credit categories: First, you could take the opportunity to secure lower interest rates. Using auto credit express to shop for refinancing options can help make your job a lot easier—if you meet the qualifications. How Do You Refinance A Car Loan With Bad Credit.

Source: carretro.blogspot.com

Source: carretro.blogspot.com

If you badly need to refinance your car no matter what, try to follow these steps: Is it right for you? Refinancing an auto loan with bad credit. Is Refinancing A Car Loan Bad For Your Credit Car Retro.

In General, You Also Dont Want To Refinance Your Car Loan If Youll End Up Extending The Loans Term.

Credit tiers are generally divided in ranges. Check your credit report and. Refinancing an auto loan with bad credit. Refinancing a vehicle with negative equity auto credit express.

The Process To Refinance A Car With Bad Credit Score.

Using auto credit express to shop for refinancing options can help make your job a lot easier—if you meet the qualifications. When it comes to refi your car with bad credit, you can contact your lender to explore options you may have. Thus, a mortgage lender will charge a person with poor or bad credit a higher interest rate to refinance because the lender is taking more of a risk by lending that person money. You refinance that loan after two years at 12% for the remaining amount of $14,257.98.

Refinancing A Car With Bad Credit Is Not Impossible, But It Can Be A Challenge For Borrowers With Lower Credit Scores.

If you want to save on your loan and get to refinancing faster, round up your auto. Even though you are taking out a new loan, you will only have one auto loan. In case there is, pay it off to finalize. A subprime loan is for people with bad credit and low fico scores.

Can I Refinance A Car Loan With Bad.

How refinancing can affect your credit score. 2) improve your credit rating. If you have a higher credit score than it was at the time of the original loan. Auto credit express has long been one of our favorite auto lending networks for bad credit because it partners with a massive group of lenders who each have flexible credit.