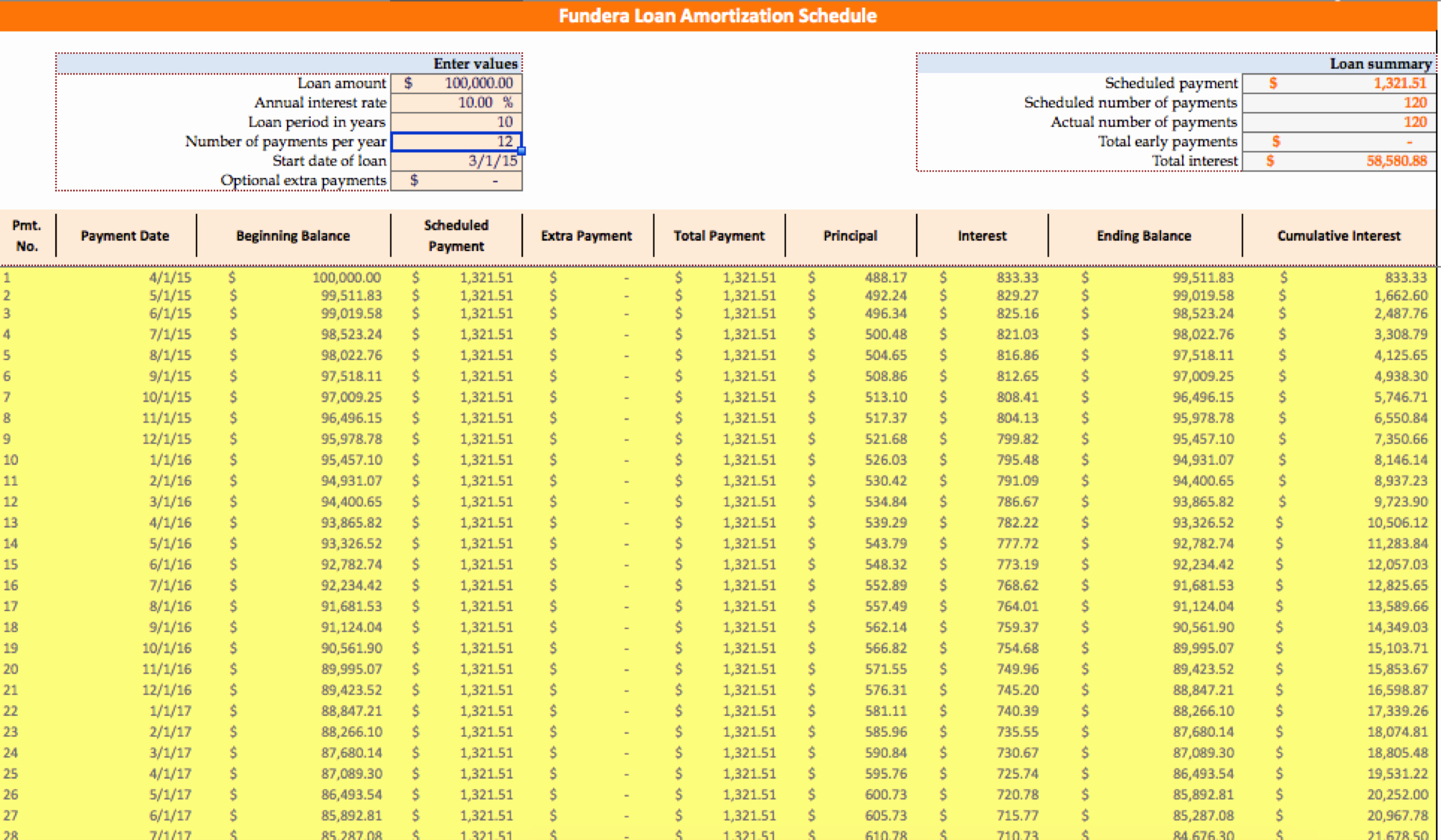

To use the online loan calculator 1, simply: Calculate the total amount owed on your short term loan by multiplying the factor rate by the amount borrowed.

, Use the personal loan calculator to find out your monthly payment and total cost of borrowing. View amortization and term schedule:.

50 Amortization Schedule with Variable Payments Template From ufreeonline.net

50 Amortization Schedule with Variable Payments Template From ufreeonline.net

Loan payment calculator with amortization schedule. Talk to a home lending specialist at. When you apply for a mortgage/loan,. Loan amortization schedule use this loan amortization calculator to determine the payment amount for any loan.

50 Amortization Schedule with Variable Payments Template It also determines out how much of your repayments will go towards.

An amortization period is the time over which equal payments and an unchanged interest rate would bring the balance of the mortgage or loan to zero. In our lease amortization schedule excel spreadsheet, there are primary inputs that drive the initial recognition of your lease liabilities under the new lease accounting standards:. I am new to power bi and would like to know if it�s possible to create a full debt amortization scehdule based on the following. You can choose a fixed or variable interest rate when you apply.

Source: ufreeonline.net

Source: ufreeonline.net

An amortizing loan is a type of loan that requires monthly payments, with a portion of the payments each going towards the principal and interest payments. In our lease amortization schedule excel spreadsheet, there are primary inputs that drive the initial recognition of your lease liabilities under the new lease accounting standards:. Amortization is the process of spreading out a loan into a series of fixed payments. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

Loan amortization schedule use this loan amortization calculator to determine the payment amount for any loan. Calculate the amount of interest paid. An amortization period is the time over which equal payments and an unchanged interest rate would bring the balance of the mortgage or loan to zero. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

You can choose a fixed or variable interest rate when you apply. Calculate how much your monthly small business loan payments might be before you apply. Enter the loan amount. enter the expected number of payments. enter the anticipated annual interest rate. set payment amount to 0 (the unknown). 50 Amortization Schedule with Variable Payments Template.

Source: listoffreeware.com

Source: listoffreeware.com

Talk to a home lending specialist at. A td auto loan is available for new. Amortization is the process of spreading out a loan into a series of fixed payments. 103 Best Free Online Amortization Schedule Maker.

Source: ufreeonline.net

Source: ufreeonline.net

Some of each payment goes toward. Calculate the payment amount, pmt. Payments are made on a monthly basis. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

Loan amortization schedule use this loan amortization calculator to determine the payment amount for any loan. Schedule an appointment view details. For example, if you borrow $10,000 at a factor rate of 1.25 for a 6. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

The loan is paid off at the end of the payment schedule. Calculate your monthly loan payment. You can choose a fixed or variable interest rate when you apply. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

Payments are made on a monthly basis. Hello every body, i would like your expert help urgently please i would like to make loan amortization schedule and i dont know. When you apply for a mortgage/loan,. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

Calculate your monthly loan payment. Calculate the amount of interest paid. Learn about the differences between a loan and a line of credit. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

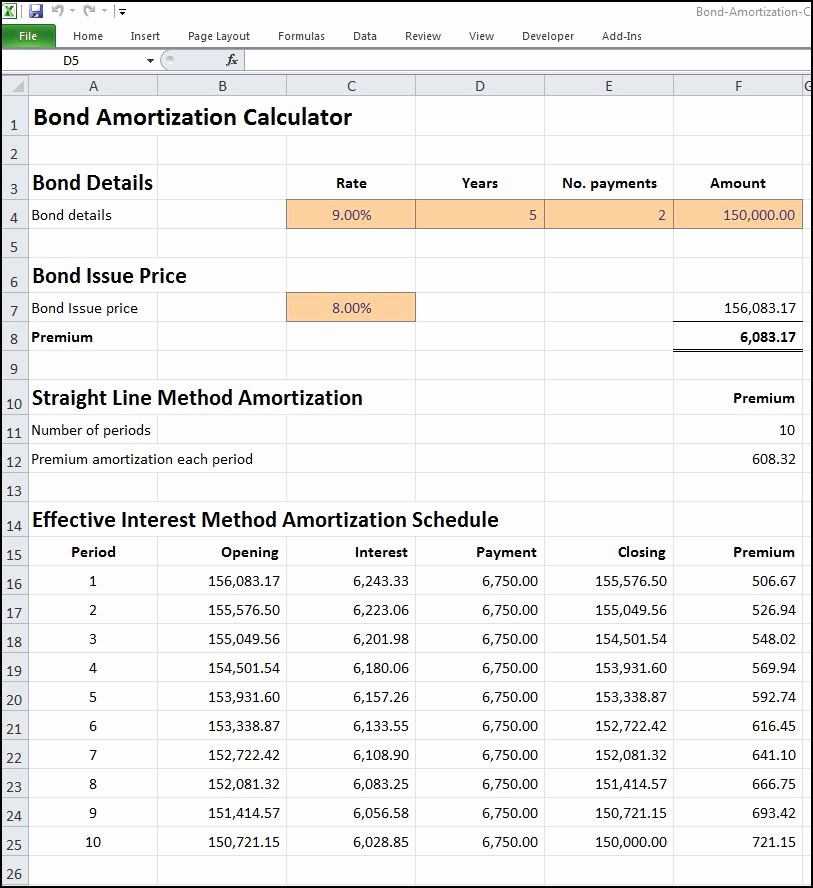

Mortgage critical illness and life insurance can help you pay up to $1,000,000 to your mortgage loan balance. An amortizing bond, on the other hand, is one that repays a portion of the principal as well as the coupon payments. Let’s look at the example of the loan amortization schedule of the above example for the first six months. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

Click either calc or print preview. Loan amortization schedule use this loan amortization calculator to determine the payment amount for any loan. The loan amortization schedule is a table that shows how the borrower will pay back the amount of the loan over the period of time stipulated. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

Steps to prepare a loan amortization schedule with variable interest rate in excel. Enter the loan amount. enter the expected number of payments. enter the anticipated annual interest rate. set payment amount to 0 (the unknown). Talk to a home lending specialist at. 50 Amortization Schedule with Variable Payments Template.

To use the online loan calculator 1, simply: Consider a $30,000 fully amortizing loan with a term of five years and a fixed interest rate of 6%. Let’s look at the example of the loan amortization schedule of the above example for the first six months. Mortgage Loan Calculator Td VAVICI.

Source: ufreeonline.net

Source: ufreeonline.net

Learn more about td credit protection. Steps to prepare a loan amortization schedule with variable interest rate in excel. I am new to power bi and would like to know if it�s possible to create a full debt amortization scehdule based on the following. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

Equal principal payment (loan amount $10,000, annual interest rate 10%, 10 annual payments) equal total payment this loan is repaid in equal. Calculate your monthly loan payment. An amortization period is the time over which equal payments and an unchanged interest rate would bring the balance of the mortgage or loan to zero. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

Amortization is the process of spreading out a loan into a series of fixed payments. Schedule an appointment view details. An amortizing loan is a type of loan that requires monthly payments, with a portion of the payments each going towards the principal and interest payments. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

This calculator uses a fixed interest rate 1. An amortization period is the time over which equal payments and an unchanged interest rate would bring the balance of the mortgage or loan to zero. Calculate the amount of interest paid. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

Calculate how much your monthly small business loan payments might be before you apply. We’ll help you create a repayment schedule with a term and amortization period that works. I am new to power bi and would like to know if it�s possible to create a full debt amortization scehdule based on the following. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

Hello every body, i would like your expert help urgently please i would like to make loan amortization schedule and i dont know. Schedule an appointment view details. I am new to power bi and would like to know if it�s possible to create a full debt amortization scehdule based on the following. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

An amortizing bond, on the other hand, is one that repays a portion of the principal as well as the coupon payments. Calculate the total amount owed on your short term loan by multiplying the factor rate by the amount borrowed. For example, if you borrow $10,000 at a factor rate of 1.25 for a 6. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

This calculator uses a fixed interest rate 1. Calculate your monthly loan payment. An amortization period is the time over which equal payments and an unchanged interest rate would bring the balance of the mortgage or loan to zero. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

Loan amortization schedule use this loan amortization calculator to determine the payment amount for any loan. Let’s look at the example of the loan amortization schedule of the above example for the first six months. Let’s say, the total value of the car is $200000.00, the annual. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

Learn about the differences between a loan and a line of credit. Longer amortization periods allow homeowners to make smaller monthly payments, but equate to more interest paid over the life of the mortgage. Steps to prepare a loan amortization schedule with variable interest rate in excel. 50 Amortization Schedule with Variable Payments Template.

Source: ufreeonline.net

Source: ufreeonline.net

Consider a $30,000 fully amortizing loan with a term of five years and a fixed interest rate of 6%. Only) and bring it to your. Let’s look at the example of the loan amortization schedule of the above example for the first six months. 50 Amortization Schedule with Variable Payments Template.

Source: listoffreeware.com

Source: listoffreeware.com

For example, if you borrow $10,000 at a factor rate of 1.25 for a 6. When you apply for a mortgage/loan,. In our lease amortization schedule excel spreadsheet, there are primary inputs that drive the initial recognition of your lease liabilities under the new lease accounting standards:. 103 Best Free Online Amortization Schedule Maker.

The Loan Amortization Schedule Is A Table That Shows How The Borrower Will Pay Back The Amount Of The Loan Over The Period Of Time Stipulated.

For example, if you borrow $10,000 at a factor rate of 1.25 for a 6. Type into the personal loan calculator the loan. Learn more about td credit protection. In our lease amortization schedule excel spreadsheet, there are primary inputs that drive the initial recognition of your lease liabilities under the new lease accounting standards:.

You Can Choose A Fixed Or Variable Interest Rate When You Apply.

The amount due is 14,000 usd at a 6% annual interest rate and two years payment. Enter the loan amount. enter the expected number of payments. enter the anticipated annual interest rate. set payment amount to 0 (the unknown). Calculate the amount of interest paid. Payments are made on a monthly basis.

It Also Determines Out How Much Of Your Repayments Will Go Towards.

Loan amount $ interest rate % term months: Calculate the payment amount, pmt. When you apply for a mortgage/loan,. Amortization is the process of spreading out a loan into a series of fixed payments.

An Amortization Period Is The Time Over Which Equal Payments And An Unchanged Interest Rate Would Bring The Balance Of The Mortgage Or Loan To Zero.

Calculate the total amount owed on your short term loan by multiplying the factor rate by the amount borrowed. Find a td bank near you. Learn about the differences between a loan and a line of credit. Mortgage critical illness and life insurance can help you pay up to $1,000,000 to your mortgage loan balance.